NASDAQ’S BOARD DIVERSITY RULE WHAT NASDAQ-LISTED COMPANIES SHOULD KNOW

Nasdaq’s Board Diversity Rule, which was approved by the SEC on August 6, 2021, is a disclosure standard designed to encourage a minimum board diversity objective for companies and provide stakeholders with consistent, comparable disclosures concerning a company’s current board composition.

If you have questions about the implementation of the rule or gaining access to complimentary resources to facilitate your board search, email us at drivingdiversity@nasdaq.com.

BOARD DIVERSITY RULE

Nasdaq’s Board Diversity Rule requires companies listed on our U.S. exchange to:

• Publicly disclose board-level diversity statistics using a standardized template; and

• Have or explain why they do not have at least two diverse directors.

The rule also provides additional flexibility for Smaller Reporting Companies and Foreign Issuers, which can meet the diversity objective by including two female directors, and for all companies with five or fewer directors, which can meet the diversity objective by including one diverse director.

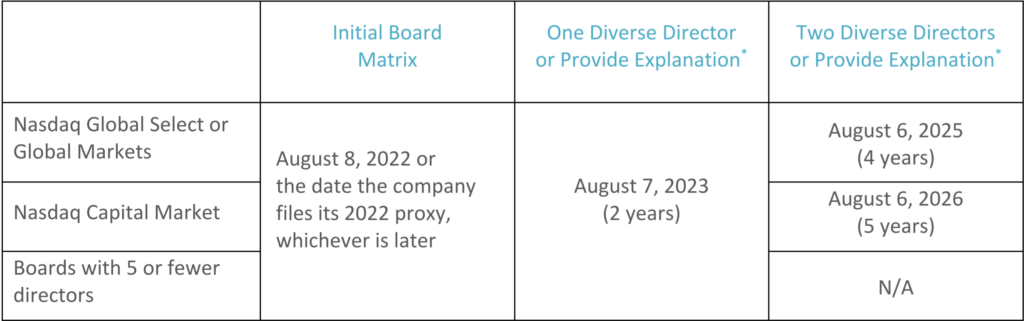

The following table summarizes the transition periods for companies listed on Nasdaq prior to August 6, 2021.

Transition periods for companies listing on or after August 6, 2021 are detailed here.

WHAT NASDAQ-LISTED COMPANIES SHOULD KNOW

1. Nasdaq will host several live webinars to help companies understand key elements of the Board Diversity Rule.

Nasdaq will host several live webinars to help companies understand key elements of the rule, how to gain access to a variety of freeboard recruiting services, and give participants an opportunity to ask questions. Webinars will also be available for replay for attendees.

2. Companies need to disclose board-level diversity data annually.

All operating companies listed on Nasdaq’s U.S. exchange will need to use the Board Diversity Matrix found here, or a format substantially similar, to annually disclose board-level diversity data. Companies will provide this disclosure in the company’s proxy statement or its information statement (or if the company does not file a proxy, its Form 10-K or 20-F), or on the company’s website. Examples of acceptable (i.e., same or substantially similar) and unacceptable (i.e., substantially different) disclosures are provided here. As noted in the chart above, companies must disclose the initial matrix in 2022.

- If a company files its 2022 proxy BEFORE August 8, 2022 and DOES NOT include the Matrix, then the company has until August 8, 2022 to provide the Matrix in its Form 10-K or on its website.

- If a company files its 2022 proxy ON or AFTER August 8, 2022, then it must either include the Matrix in its proxy or post the Matrix on its website.

- If a company does not intend to file a 2022 proxy, then the company has until August 8, 2022 to provide the Matrix on its website.

Companies that elect to provide the Matrix on their website must also complete a short form through the Listing Center that includes the URL link to the disclosure.

3. Companies need to meet a board diversity objective or explain their reasons for not doing so, and the explanation could include describing a different approach.

Nasdaq-listed companies that do not have at least two diverse directors, including one who self-identifies as female and one who self-identifies as either an underrepresented minority or LGBTQ+, can provide an explanation for not doing so, and their explanation could include a description of a different approach. Nasdaq will verify that the company has provided an explanation, but will not assess the merits of the explanation. This rule is not a mandate. If a company chooses to explain why it does not meet the diversity objectives, it can provide its explanation in its proxy statement, information statement for its annual shareholder meeting, or on the company’s website.

4. There is a transition period for companies to meet the diversity objectives, or explain why they do not.

As noted in the chart above, companies have a transition period to meet the diversity objectives or explain their reasons for not doing so.

5. Smaller Reporting Companies, Foreign Issuers, and companies with five or fewer directors have additional flexibility to meet the diversity objectives.

Smaller Reporting Companies have additional flexibility and can meet the diversity objective with two female directors, or with one female director and one director who is an underrepresented minority or LGBTQ+. Similarly, Foreign Issuers can meet the diversity objective with two female directors, or with one female director and one director who is an underrepresented individual based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in the country of the company’s principal executive offices, or LGBTQ+. Companies with five or fewer directors can meet the diversity objective by having at least one diverse director. As with other Nasdaq-listed companies, if a company chooses to explain why it does not meet the diversity objectives, it can provide its explanation in its proxy statement, information statement for its annual shareholder meeting, or on the company’s website.

6. Non-operating companies, including SPACs until they complete their business combinations, are exempt from the Board Diversity Rule.

SPACs listed under Nasdaq Rule IM-5101-2 are not required to provide the board diversity matrix or to meet, or explain why they do not meet, the board diversity objective until after their business combination. In addition to SPACs, limited partnerships, closed end funds, management investment companies and issuers of exchanged traded products, among others, are exempt from the Board Diversity Rule. Refer to FAQs 1762, 1763, and 1764 for more information regarding exemptions and how the Rule applies after a SPAC completes a business combination.

7. Nasdaq-listed companies have access to a variety of free board recruiting services.

Nasdaq is proud to have established partnerships with Equilar, Athena Alliance, Heidrick & Struggles, and the Boardlist. We realize one size doesn’t fit all, which is why we are building relationships with a growing number of collaborative partners. To learn more about these relationships and how your company can access these resources, please review our guide to Advancing Boardroom Diversity. You can also email your Relationship Manager or Vanessa Mesics at Vaness.Mesics@nasdaq.com.

8. We are prepared to help.

We maintain a toolkit of resources to help the listed companies and their advisors understand and achieve compliance with these new requirements.

FAQs. A list of Frequently Asked Questions is available below.

Or email your questions to info@ppmtgroup.com

Frequently Asked Questions

How does Nasdaq define “Underrepresented Minority” for companies incorporated in the U.S.?

For companies incorporated in the U.S., “Underrepresented Minority” means an individual who self-identifies as one or more of the following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or Two or More Races or Ethnicities.

“Two or More Races or Ethnicities” means a person who identifies with more than one of the following categories: White (not of Hispanic or Latinx origin), Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander.

Who qualifies as an “underrepresented individual” for a Foreign Issuer?

For a Foreign Issuer, an “underrepresented individual” is defined as a person who self-identifies as an underrepresented individual based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in the country where the Foreign Issuer’s principal executive offices are located.

How does Nasdaq define “Smaller Reporting Companies” for purposes of the Board Diversity Rule?

“Smaller Reporting Company” has the definition set forth in Rule 12b-2 under the Act. Under 12b-2 of the Act, a Smaller Reporting Company “means an issuer that is not an investment company, an asset-backed issuer (as defined in § 229.1101 of this chapter), or a majority-owned subsidiary of a parent that is not a smaller reporting company and that: (1) Had a public float of less than $250 million; or (2) Had annual revenues of less than $100 million and either: (i) No public float; or (ii) A public float of less than $700 million.”

What flexibility does Nasdaq provide for Smaller Reporting Companies in connection with the Board Diversity Rule?

Smaller Reporting Companies may satisfy the minimum diversity objective by including two female directors, or by including one female director and an individual who self-identifies as LGBTQ+ or an Underrepresented Minority.

In addition, all companies listed on our Nasdaq Capital Market receive an additional year to meet the minimum diversity objectives or explain why they do not meet the minimum diversity objectives. The minimum diversity objectives for these companies are one director within two years of the Effective Date (August 6, 2021) and two within five years of the Effective Date. If a company files its proxy statement or its information statement (or, if the company does not file a proxy, in its Form 10-K or 20-F) for the company’s annual shareholders meeting after the anniversary of the Effective Date in the calendar year for each respective year noted above, then the company will have until the date it makes such filing to meet, or explain why it does not meet, the applicable diversity objectives.

How does Nasdaq define “Foreign Issuer” for purposes of the Board Diversity Rule?

Nasdaq defines a Foreign Issuer as (a) a Foreign Private Issuer (as defined in Rule 5005(a)(19)) or (b) a company that (i) is considered a “foreign issuer” under Rule 3b-4(b) under the Act and (ii) has its principal executive offices located outside of the United States. This includes all Foreign Private Issuers and any foreign issuers that are not Foreign Private Issuers so long as their principal executive offices are also located outside of the United States.

What flexibility does Nasdaq provide to foreign companies in connection with the Board Diversity Rule?

Foreign Issuers may satisfy the minimum diversity objective by including two female directors, or by including a female director and an individual who self-identifies as LGBTQ+ or an underrepresented individual based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in the country where the Foreign Issuer’s principal executive offices are located. Foreign Issuers may also elect to satisfy the board composition disclosure requirement through an alternative disclosure matrix template. View examples of acceptable (i.e., same or substantially similar) and unacceptable (i.e., substantially different) disclosures here.

How does Nasdaq’s Board Diversity Rule apply to SPACs?

SPACs listed under IM-5101-2 are exempt from Nasdaq’s Board Diversity Rule until they de-SPAC. They are not required to provide the disclosure information or to have, or disclose that they do not have, any minimum number of diverse directors until their business combination. Following the business combination, such companies must meet or explain why they do not meet, the applicable diversity objectives by the later of two years from the date of listing or the date the company files its proxy statement or its information statement (or, if the company does not file a proxy, in its Form 10-K or 20-F) for the company’s second annual meeting of shareholders subsequent to the company’s listing, with differing milestones depending on the company’s market tier.

Are any companies exempt from Nasdaq’s Board Diversity Rule?

Yes. The Board Diversity Rule exempts non-operating companies. Consistent with Nasdaq’s corporate governance rules the following types of companies are exempt:

– acquisition companies listed under IM-5101-2;

– asset-backed issuers and other passive issuers. Note while closed-end funds are exempt from the rule, business development companies are not (as set forth in Rule IM-5615-4);

– cooperatives (as set forth in Rule 5615(a)(2));

– limited partnerships (as set forth in Rule 5615(a)(4));

– management investment companies (as set forth in Rule 5615(a)(5));

– issuers of only non-voting preferred securities, debt securities, and Derivative Securities (as set forth in Rule 5615(a)(6)); and

– issuers of securities listed under the Rule 5700 Series, including exchange-traded products.

If a company ceases to be an Exempt Company under the Board Diversity Rule, when does that company have to have two diverse directors?

Any company that ceases to be an Exempt Company will have until the later of: (i) one year from the date that the company no longer qualifies as an Exempt Company, or (ii) the date the company files its proxy statement or its information statement (or, if the company does not file a proxy, in its Form 10-K or 20-F) for the company’s first annual meeting of shareholders subsequent to such event.

What happens if a company can’t find diverse directors by the applicable deadline set forth in Nasdaq’s Board Diversity Rule?

If a company has not been able to add the minimum number of diverse directors by the applicable deadlines, the company can satisfy the diversity objectives of the Rule by providing an explanation, following the specific disclosure instructions set forth in Rule 5605(f)(3).

Can a company be delisted for failing to add the minimum diverse board members or for failing to disclose board diversity metrics as required by Nasdaq’s Board Diversity Rule?

If a company (i) does not meet the diversity objectives set forth under Rule 5605(f)(2) and also does not provide an explanation as set forth in Rule 5605(f)(3) (and is not otherwise subject to a grace period), then Nasdaq’s Listing Qualifications Department would promptly notify the company that it has until the later of its next annual shareholders’ meeting or 180 days from the event that caused the deficiency to cure the deficiency. The company can cure the deficiency either by meeting the applicable minimum diversity objectives of Rule 5605(f)(2) or providing an explanation as set forth in Rule 5605(f)(3). If a company does not regain compliance within the applicable cure period, the Listings Qualifications Department would issue a Staff Delisting Determination Letter. A company that receives a Staff Delisting Determination can appeal the determination to the Hearings Panel through the process set forth in Rule 5815.

If a company does not disclose board diversity matrix as set forth in Rule 5606, Nasdaq will notify the company that it is not in compliance with a listing requirement, and the company will be allowed 45 calendar days to submit a plan sufficient to satisfy Nasdaq staff that the company has adopted processes and procedures designed to identify and disclose the information required under Rule 5606 in the future. If the company does not do so, it would be issued a Staff Delisting Determination, which the company could appeal to a Hearings Panel pursuant to Rule 5815.

How do companies comply with Nasdaq’s Board Diversity Rule?

The Board Diversity Rule requires all companies listed on Nasdaq’s U.S. exchange to publicly disclose board-level diversity statistics using a standardized disclosure matrix template. Additionally, the Board Diversity Rule requires most Nasdaq-listed companies to either (i) have at least two diverse directors, including one who self-identifies as female and one who self-identifies as either an Underrepresented Minority or LGBTQ+ or (ii) explain why they do not have two diverse directors. Foreign companies and smaller reporting companies have additional flexibility in satisfying the minimum diversity objective with two female directors, and companies with boards of five or fewer members can satisfy it with one diverse director.

For more information, read Nasdaq’s Board Diversity Rule: What Nasdaq-Listed Companies Should Know. View instructions for completing Nasdaq’s disclosure matrix template here. Examples of acceptable (i.e., same or substantially similar) and unacceptable (i.e., substantially different) disclosures are provided here.

When are companies required to comply with the Diverse Director Objective?

Companies have a transition period to meet the diversity objectives or explain their reasons for not doing so. The timeframe to meet the minimum diversity objectives is based on a company’s listing tier:

– Companies listed on Nasdaq Global Select Market or Nasdaq Global Market are required to have or explain why they do not have, one diverse director by August 7, 2023, and two diverse directors by August 6, 2025.

– Companies listed on the Nasdaq Capital Market are required to have or explain why they do not have, one diverse director by August 7, 2023, and two diverse directors by August 6, 2026.

– Companies with boards that have five or fewer directors, regardless of listing tier, are required to have or explain why they do not have, one diverse director by August 7, 2023.

If a company files its proxy statement or its information statement (or, if the company does not file a proxy, in its Form 10-K or 20-F) for the company’s annual shareholders meeting after the anniversary of the Effective Date in the calendar year for each respective year noted above, then the company will have until the date it makes such filing to meet, or explain why it does not meet, the applicable diversity objectives.

For companies that are not in a position to meet the minimum diversity objectives within the required timeframes, they will not be subject to delisting if they provide an alternative public disclosure explaining why they did not meet the applicable minimum diversity objectives.